child tax credit after december 2021

For 2021 eligible parents or guardians can receive up to 3600 for each child who. If you havent yet filed your tax return you still have time to file to get your full Child Tax Credit.

Parents Struggle After Monthly Child Tax Credit Payments End

1 day agoOctober 5 2022 807 am.

. 4 fixing the timing of the states child tax. It helped roughly 60 million children and helped cut child. Families will receive the other half when they submit their 2021 tax return next season.

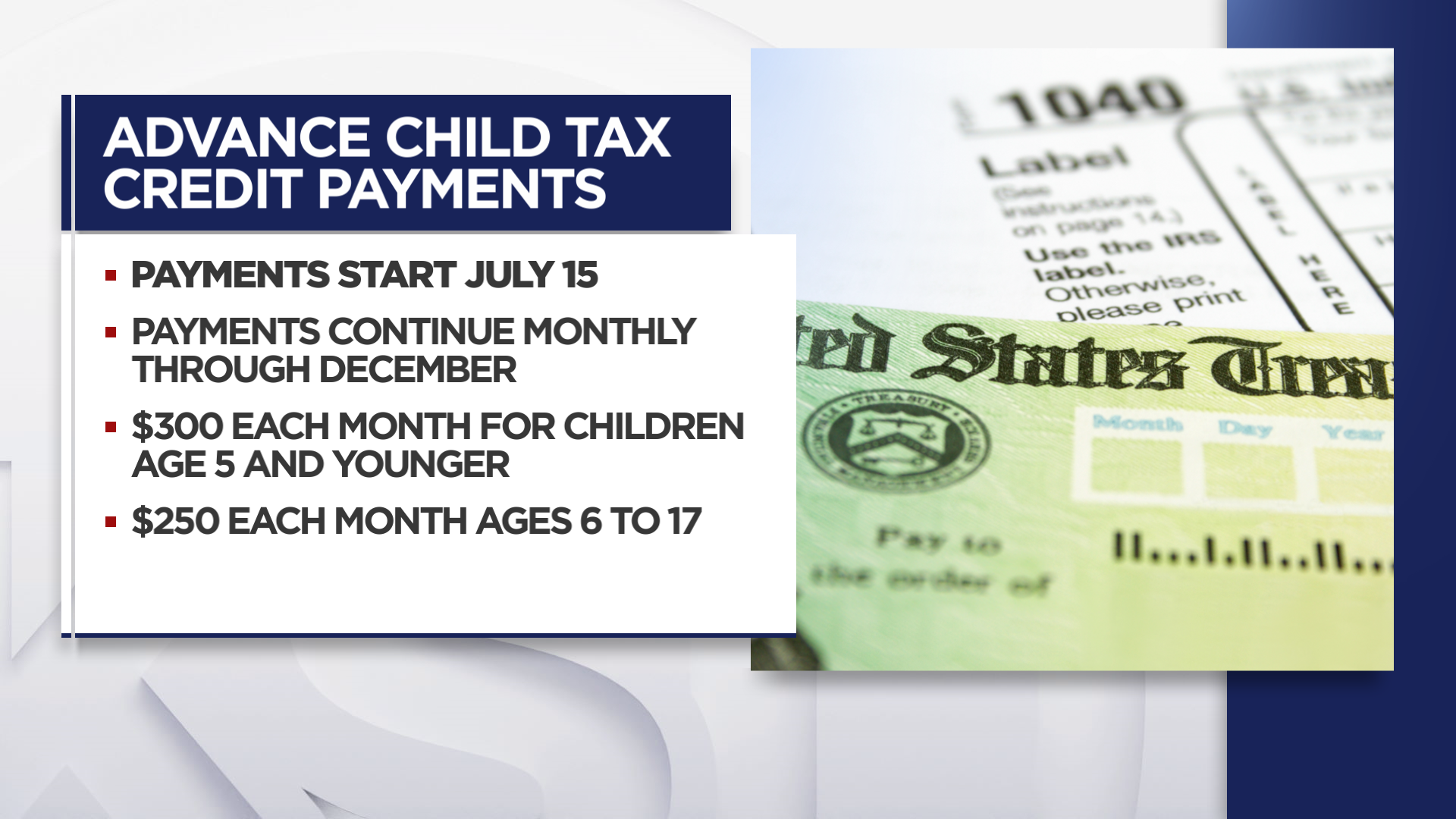

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000. Monthly child tax credit expires Friday after Congress failed to renew it Because the Build Back Better agenda was not passed by the Senate before the end of the year. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

The credit amounts will increase for many. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Just one day after an amended bill was passed by the Assembly Gov.

The expansion has increased the amount for children age 0 through 5 and children ages 6. Visit ChildTaxCreditgov for details. Phil Murphy signed legislation Oct.

2021 though you can still collect the remaining half of your credit either 1800 or 1500 when you file your 2021 tax. December 8 2021 401 PM CBS News The families of some 61 million children could see their monthly Child Tax Credit payments end after next week if Congress does not. Even if you received all six early payments you still have.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. 1 day agoIt was expanded in 2021 as part of President Joe Bidens 19 trillion coronavirus relief package. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The child tax credit wasnt new when Democrats over the objections of Republicans in Congress altered the program as part of Bidens 19 trillion coronavirus relief. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. Advanced child tax credits are expected to end in Dec.

Before 2021 the child tax credit was worth 2000 for children age 0 through 16. This increased payments up to 3600 annually for each child aged 5 or under. Theres Still Time to Get the Child Tax Credit.

Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. The Child Tax Credit provides money to support American families. Here is some important information to understand about this years Child Tax Credit.

1 day agoOther temporary changes in 2021 included delivering 50 of the credit in advance monthly payments beginning in July 2021 and the remaining 50 claimed on a 2021 tax return. In total the expanded credit provides up to 3600 for each younger child and up to. Although the advance child tax credit payments are not taxable income you still want to report them on your taxes.

Families Can Now Register For Child Tax Credit Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month Wgn Tv

Expanded Child Tax Credit Here Are The New Changes This Year

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Covid Expanded Child Tax Credit Benefit Nears Lapse Wvns

Child Tax Credits To End Dec 31 Unless Dems Pass Build Back Better Act Katu

The Impacts Of The 2021 Expanded Child Tax Credit On Family Employment Nutrition And Financial Well Being Social Policy Institute Washington University In St Louis

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Congress Votes To Increase Child Tax Credit Bring More Families Out Of Poverty Youtube

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit 2021 8 Things You Need To Know District Capital

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

The Child Tax Credit The White House

![]()

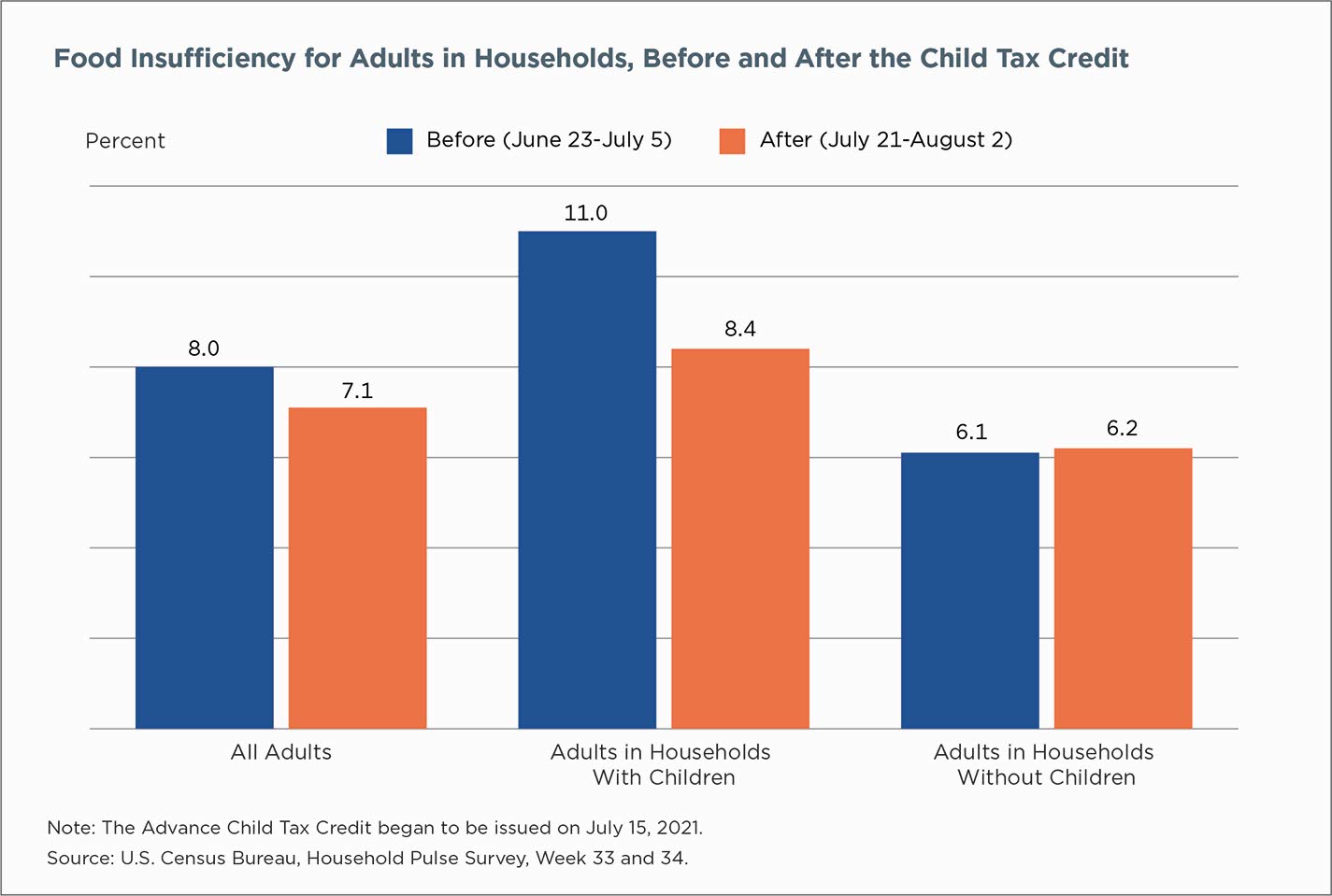

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

Families Saw Less Economic Hardship As Child Tax Credit Payments Came